Subpoenas issued by a federal grand jury in Florida suggest that the FBI has launched an investigation into the gubernatorial campaign of former Tallahassee mayor Andrew Gillum, who lost a close election for the Sunshine State’s highest office to Republican Ron DeSantis last year.

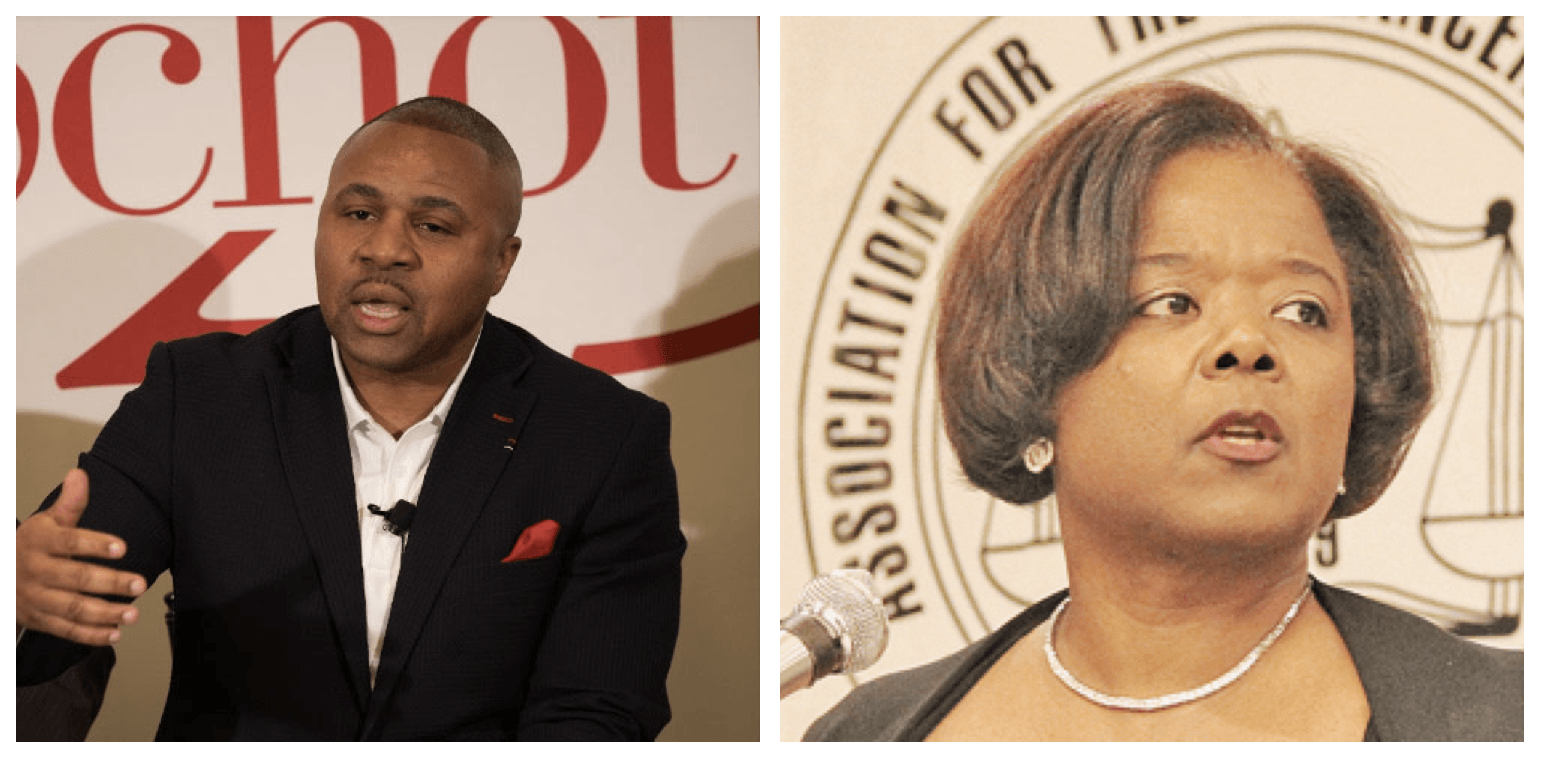

According to the Tampa Bay Times, federal investigators are also exploring Gillum’s ties to two Massachusetts-based anti-education reform organizations – the Schott Foundation for Public Education and its affiliated 501(c)(4), the Opportunity To Learn Action Fund – and have demanded information about Schott CEO and president John H. Jackson and board member Sharon Lettman-Hicks.

Tax filings show that Gillum was a member of the board of directors of the Schott Foundation as recently as June 2017. He concurrently served as president of the Opportunity To Learn Action Fund (OTLAF), which is directly controlled by Schott, although he did not earn a salary in that role.

This isn’t the first time that questions have been raised about Gillum’s conduct. In August 2015, a year into Gillum’s tenure as mayor of Tallahassee, the FBI launched an undercover corruption investigation of the city government. Although Gillum was never directly implicated, three city officials were eventually indicted on racketeering, bribery, extortion, bank fraud, and wire fraud charges.

It subsequently emerged that Gillum had accepted tickets to the Broadway musical “Hamilton,” as well as a free hotel room from an undercover FBI agent who was posing as a real estate developer during a 2016 trip to New York. In April, Gillum paid a $5000 fine to settle charges related to the Hamilton trip brought by the Florida Commission on Ethics.

A closer look at the Schott & Opportunity To Learn

The recent subpoenas mean that Gillum’s settlement with the ethics commission may not mark the end of his legal troubles. They also bring a new level of scrutiny to the inner workings of the Schott Foundation.

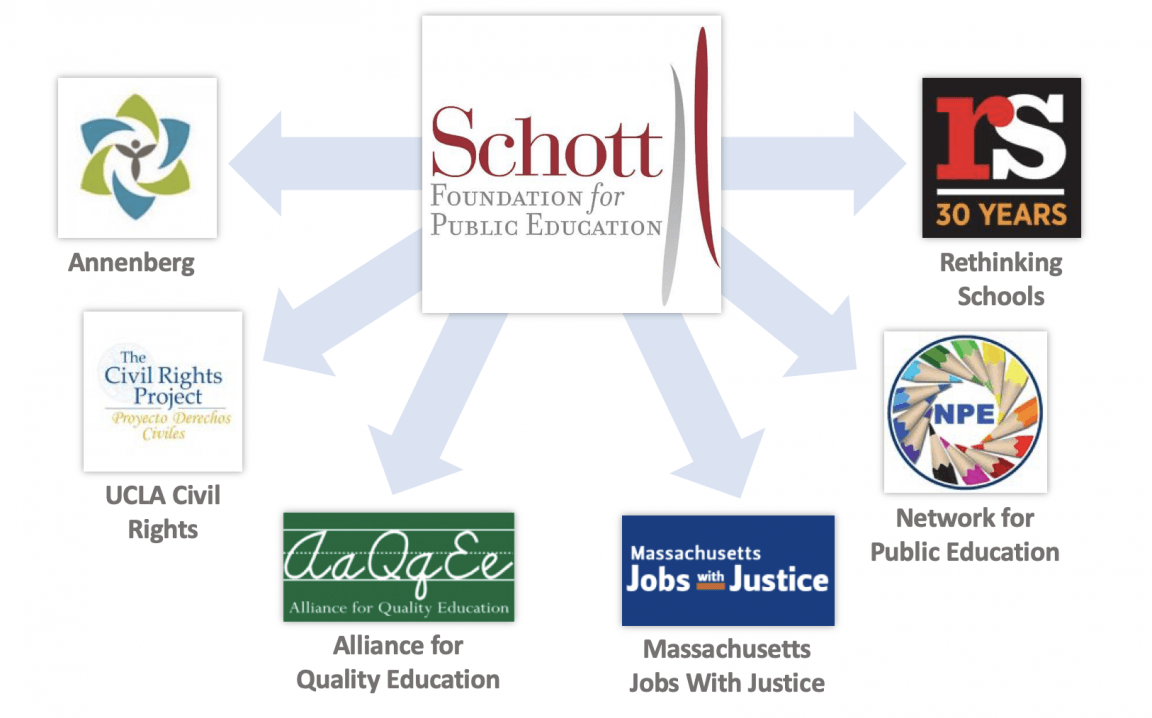

The Schott Foundation’s self-declared mission is “to develop and strengthen a broad-based and representative movement to achieve fully resourced, quality PreK-12 public education.” In reality, Schott works in lockstep with the national teachers unions in three key areas. First, it provides grants to anti-reform groups such as the Network for Public Education, Alliance for Quality Education, Annenberg Center for School Reform at Brown University, and UCLA Civil Rights Project.

Furthermore, as I explained in a 2017 op-ed in The Seventy-Four, Schott organizes and underwrites trainings for its nationwide network of grantees, many of which focus on messaging and communications strategy. Finally, Schott engages in policy development and advocacy, and has published dozens of reports opposing charters, accountability, and standardized testing.

Read my piece in The 74:

Cook: Charter Activists Know How to Walk the Walk but Not How to Talk the Talk

The 74 is moderating a panel Wednesday at the 24th annual California Charter Schools Conference in Sacramento, about inaccurate narratives surrounding public charter schools and how the mainstream media covers, and occasionally distorts, the sector. (Livestream will start here at 1:45pm EST.)

But the strange thing about the Schott Foundation is that it’s not a foundation in the traditional sense of the word. Its most recent available tax filings reveal that Schott has less than $9 million in assets, and unlike other philanthropic foundations, it makes very little revenue from investments. In fact, a review of the Schott Foundation’s tax returns between 2013 and 2017 indicates that the vast majority of its revenue comes from outside contributions and grants (97% of total revenue in F.Y. 2017) and it tends to spend only as much as it takes in. All of which suggests that Schott primarily serves as a conduit for other people’s money.

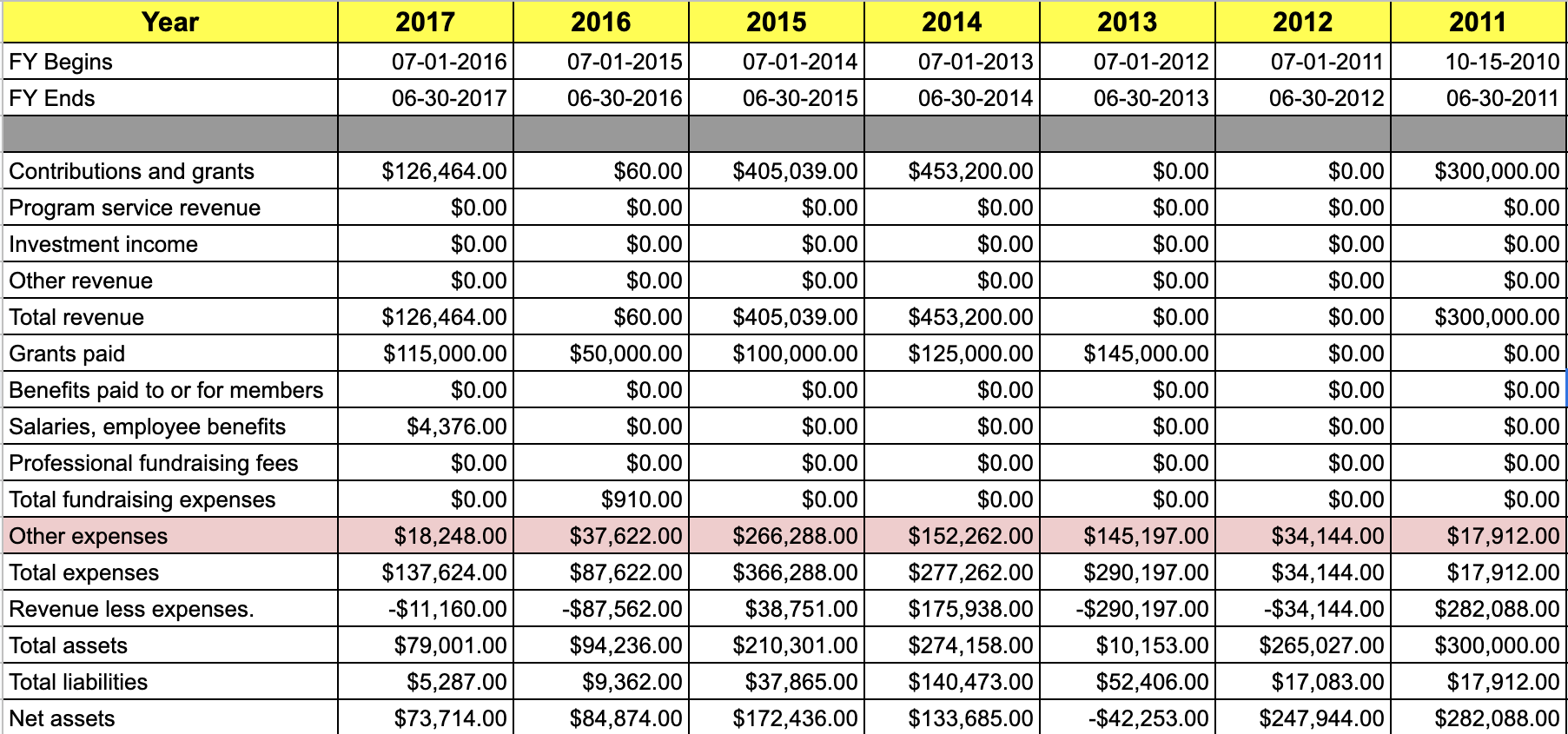

Annual financial reports to the U.S. Department of Labor show that the American Federation of Teachers (AFT) and National Education Association (NEA) have given Schott and OTLAF a total of $1,330,000 since 2011, although the overwhelming majority of that money ($1,275,000) went to the Opportunity To Learn Action Fund. Moreover, tax records indicate that AFT and NEA’s contributions accounted for more than 99% of OTLAF’s revenues between 2011 and 2017.

Opportunity To Learn tax filings raise questions, shine light

A review of those same tax records raises questions about the organization’s accounting practices. For example, OTLAF’s tax returns state the organization had no revenue during the fiscal year that ended June 30th, 2012.

However, NEA’s 2012 annual report to the U.S. Department of Labor reveals that the union made two $150,000 contributions to the organization in October 2011 and March 2012.

There is a similar discrepancy for OTLAF’s 2016 tax filings, in which the organization reported only $60 in revenue.

Once again, this conflicts with AFT’s 2016 annual report to the Department of Labor, which indicates that the union gave Opportunity To Learn $75,000 in August 2015.

How the Opportunity To Learn Action Fund actually spent the funding it got from AFT and NEA also invites scrutiny. Of the nearly $1,285,000 in revenue the organization received between 2011 and 2017, OTLAF reported that it spent 52% of that money ($671,673) as “Other Expenses” on their tax returns, a category which encompasses what are more commonly known as overhead costs. This appears rather high given that the National Council for Nonprofits says that the normal range for overhead rates is 25-35%.

But perhaps the most interesting revelations in Opportunity To Learn’s tax returns is who received the $535,000 in grants the organization distributed during the same period. In F.Y. 2017, OTLAF gave $45,000 to Massachusetts Jobs With Justice Action Fund and $10,000 to the New England Area Conference of the NAACP. On its tax return, OTLAF stated that these grants were made in support of Save Our Public Schools, a referendum committee that opposed Question 2, a ballot initiative that sought to lift the charter school cap in Massachusetts.

It just so happens that both Jobs With Justice and the New England Conference of the NAACP joined the Save Our Public Schools campaign, which raises the question of whether AFT and NEA used the OTLAF grants to buy the support of those organizations.1

OTLAF also made grants to organizations involved in the effort to defeat a 2016 constitutional amendment that would have created an “Opportunity School District” in Georgia with the power to takeover perennially failing public schools.

Furthermore, OTLAF gave $100,000 to underwrite the anti-reform documentary, “Backpack Full of Cash,” which was narrated by Matt Damon. The film has been heavily promoted by AFT and NEA, which makes sense, since they essentially paid for it via Opportunity to Learn.

It should be noted that the grand jury subpoenas issued to the Schott Foundation and Opportunity To Learn Action Fund do not necessarily mean that those organizations are officially the subjects of an FBI investigation. Nevertheless, it will be interesting to see what, if anything, emerges from the grand jury probe in the coming weeks and months.

- UPDATE: 06/11/19 – Interestingly enough, the New England Conference of the NAACP had its tax exempt status revoked by the IRS in May 2017 for failing to file tax returns for three consecutive years. ↩

One Comment

Leave a Reply